Will you be prepared to cover the costs of long-term care?

Medicare often falls short when it comes to covering certain expenses. Cavalry knows how to prepare for it.

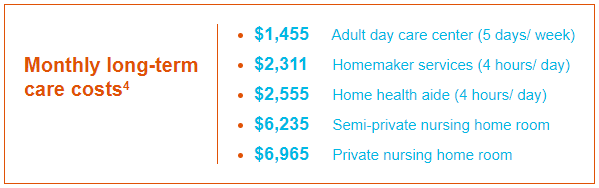

As you look ahead to what you hope will be a long and fulfilling retirement, there’s one financial reality to keep in mind: People turning 65 today have almost a 70% chance of needing some type of long-term care. And Medicare generally doesn’t cover the cost of that care.

Planning for this major “what if” is top of mind for many families — no parent wants to be a burden to their children later in life, and no adult child wants to see their parent struggling to afford the healthcare they need.

The implications of long-term care extend beyond personal finances, affecting family dynamics and quality of life. Many aging individuals fear becoming a burden to their children, while adult children worry about their parent’s ability to afford necessary healthcare. This concern is well-founded, as the need for assistance with daily activities and medical appointments can arise seemingly overnight, and from various factors, including illness, cognitive decline, or the natural aging process.

The impact of long-term care needs is far-reaching. Approximately 50% of people will assume caregiver roles for loved ones at some point in their lives. Regardless of socioeconomic status, the need for long-term care can have profound effects on health, lifestyle, and financial stability.

Proactive planning through long-term care insurance and comprehensive financial strategies is essential. Such preparation provides options for care, helps maintain lifestyle expectations, and protects family members’ livelihoods by ensuring adequate cash flow during periods of caregiving. Without proper planning, individuals and families may face devastating financial consequences.

So what are your options as you begin to think ahead to how you’ll pay for the care you or your parents might need?

Discussing signs of aging or declining health can be an uncomfortable but important conversation to have with a loved one. Discussing long-term care insurance is the most loving and important financial conversation you will ever have.

Who Needs Long-Term Care?

It is difficult to predict what sort of long-term care an individual might need or for how long care may be required. Several factors increase the risk of needing long-term care.

- Age the risk of a care need generally increases as people grow older, today many of us are are living well into our 90s.

- Gender Women are at higher risk than men, primarily because they often live longer or have been a care provider for another.

- Marital status Single people are more likely than married people to wish care from a paid provider.

- Lifestyle Poor diet and exercise habits can increase an individual’s risk.

- Health and medical history these factors also affect risk and can make it tougher to aquire coverage.

- Profession career path can increase an individual’s risk, particularly physically demanding fields such as oil field service, Military, Police & Fire, or professional athlete.

Policies & Coverage

As an independent insurance provider, Cavalry offers state partnership plans, stand-alone long-term policies (cover home health, assisted living, and nursing homes), and hybrid life and long-term care insurance policies.

Available policy types, optional riders, and applicable discounts will vary depending on the carrier and the policyholder’s health status, but will typically include the above-mentioned coverages as well as group products and tax-qualified plans, riders like inflation protection and return of premium, and discounts for spouses and household members.

Thanks for stopping in.

Thanks for stopping in.